• Are your Employees claiming a maximum dollar amount for their out-of-pocket expenses? Is your Employee claiming more than their out-of-pocket expenses are claimed for the month?

• Does the Employee have medical coverage through your Plan?

• Is the Employee on their employer health plan?

• Is your Employee on a plan other than an HMO? † Is your Employee claiming their own expenses on their claim?

• Are any of your Employees on a plan with no deductible? (such as AARP)

• Are there any special medical expenses that apply to this claim?

• Does your Exchanges have any restrictions or caveats to this claim?

• Does your Exchanges have income limiting exclusions related to FSA claims?‡

• Is there an employer deduction limit for each employee?

Note that while the “process claim only from current year funds” box applies to this claim, if your FSA funds are exhausted, or you decide to settle your claim with a full payment, you are encouraged to use your current year's FSA balance that is included with your current year's paycheck or have a new FSA balance available before making a settlement payment.

If this is the case, then please note that if you are unable to pay all the claim within 60 (thirty) days of the month in which the claim was incurred, UHF may be required to reject your claim or to request additional documentation from UHF. This could delay your ability to receive federal employer contributions or even lead to a delay in the processing of FSA payments when eligible.

If your employer is offering a low contribution employer health plan, and you are eligible to participate without paying a tax penalty, you should consult your employer

As to whether your employer can contribute to an FSA.

FSA1 2012-2024 free printable template

Show details

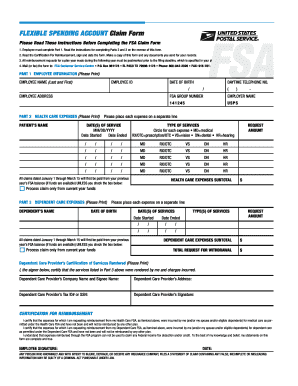

FSA FLEXIBLE SPENDING ACCOUNT FSA Claim Form FSA Grace Period UnitedHealthcare FSA Customer Service Center P. Administered by UnitedHealthcare for the United States Postal Service FSA1 NOV 2012 over Please Read These Instructions Before Completing the FSA Claim Form 1. O. Box 981506 EL PASO TX 79998-1506 Phone 800-842-2026 FAX 915-231-1709 Toll Free FAX 866-262-6354 All FSA claims with dates of service from January 1 through March 15 will first be paid from your previous year s FSA balance...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your fsa claim form 2012-2024 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fsa claim form 2012-2024 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fsa claim form online

To use the services of a skilled PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit claim form for fsa. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Video instructions and help with filling out and completing fsa claim form

Instructions and Help about fsa form

Fill fsa claim form pdf : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find fsa claim form?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific claim form for fsa and other forms. Find the template you need and change it using powerful tools.

How do I make edits in fsa forms online without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your expenses claiming, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Can I sign the fsa form fillable electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your claim expenses year form and you'll be done in minutes.

Fill out your fsa claim form 2012-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fsa Forms Online is not the form you're looking for?Search for another form here.

Keywords relevant to claim employee expenses form

Related to fsa forms printable

If you believe that this page should be taken down, please follow our DMCA take down process

here

.